Page 35 - How Australia Retires

P. 35

34 Vanguard | How Australia RetiresReport

3 4 V anguar d | R e tir emen t A t titudes

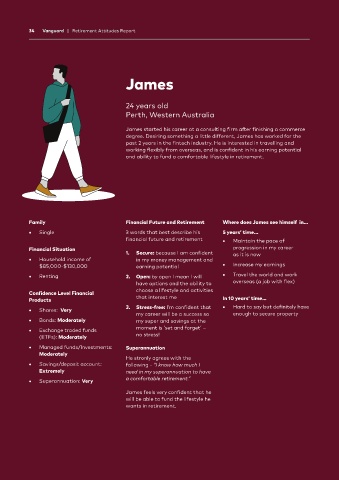

James

24 years old

Perth, Western Australia

James started his career at a consulting firm after finishing a commerce

degree. Desiring something a little different, James has worked for the

past 2 years in the fintech industry. He is interested in travelling and

working flexibly from overseas, and is confident in his earning potential

and ability to fund a comfortable lifestyle in retirement.

Family Financial Future and Retirement Where does James see himself in...

• Single 3 words that best describe his 5 years’ time...

financial future and retirement • Maintain the pace of

Financial Situation progression in my career

1. Secure: because I am confident as it is now

• Household income of in my money management and

$85,000-$130,000 earning potential • Increase my earnings

• Renting 2. Open: by open I mean I will • Travel the world and work

have options and the ability to overseas (a job with flex)

Confidence Level Financial choose a lifestyle and activities

Products that interest me In 10 years’ time…

• Shares: Very 3. Stress-free: I’m confident that • Hard to say but definitely have

my career will be a success so enough to secure property

• Bonds: Moderately my super and savings at the

• Exchange traded funds moment is ‘set and forget’ –

(ETFs): Moderately no stress!

• Managed funds/Investments: Superannuation

Moderately

He stronly agrees with the

• Savings/deposit account: following - “I know how much I

Extremely need in my superannuation to have

• Superannuation: Very a comfortable retirement.”

James feels very confident that he

will be able to fund the lifestyle he

wants in retirement.