Page 9 - How Australia Retires

P. 9

08 Vanguard | Retirement Attitudes Report

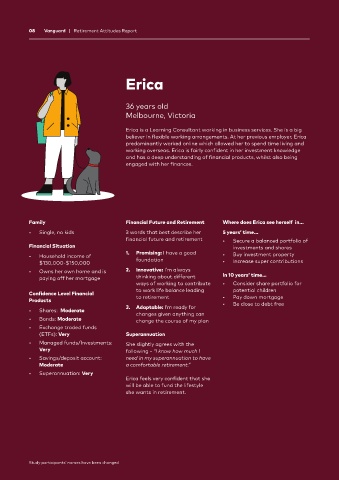

Erica

36 years old

Melbourne, Victoria

Erica is a Learning Consultant working in business services. She is a big

believer in flexible working arrangements. At her previous employer, Erica

predominantly worked online which allowed her to spend time living and

working overseas. Erica is fairly confident in her investment knowledge

and has a deep understanding of financial products, whilst also being

engaged with her finances.

Family Financial Future and Retirement Where does Erica see herself in...

• Single, no kids 3 words that best describe her 5 years’ time...

financial future and retirement • Secure a balanced portfolio of

Financial Situation investments and shares

1. Promising: I have a good

• Household income of foundation • Buy investment property

$130,000-$150,000 • Increase super contributions

• Owns her own home and is 2. Innovative: I’m always In 10 years’ time…

paying off her mortgage thinking about different

ways of working to contribute • Consider share portfolio for

to work life balance leading potential children

Confidence Level Financial to retirement • Pay down mortgage

Products • Be close to debt free

3. Adaptable: I’m ready for

• Shares: Moderate changes given anything can

• Bonds: Moderate change the course of my plan

• Exchange traded funds

(ETFs): Very Superannuation

• Managed funds/Investments: She slightly agrees with the

Very following - “I know how much I

• Savings/deposit account: need in my superannuation to have

Moderate a comfortable retirement.”

• Superannuation: Very

Erica feels very confident that she

will be able to fund the lifestyle

she wants in retirement.

Study participants’ names have been changed