Page 12 - Best of the Best | The Only Prescription for Healthy Finances

P. 12

Quality’s Performance Across the

Business Cycle

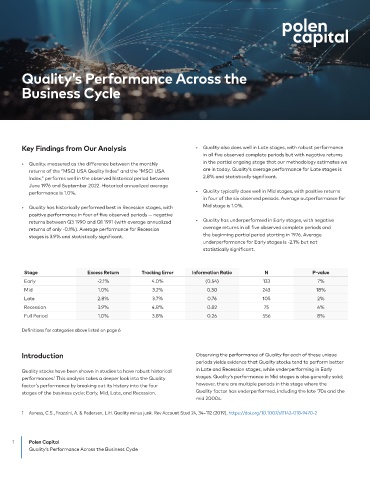

Key Findings from Our Analysis • Quality also does well in Late stages, with robust performance

in all five observed complete periods but with negative returns

• Quality, measured as the difference between the monthly in the partial ongoing stage that our methodology estimates we

returns of the “MSCI USA Quality Index” and the “MSCI USA are in today. Quality’s average performance for Late stages is

Index,” performs well in the observed historical period between 2.8% and statistically significant.

June 1976 and September 2022. Historical annualized average

performance is 1.0%. • Quality typically does well in Mid stages, with positive returns

in four of the six observed periods. Average outperformance for

• Quality has historically performed best in Recession stages, with Mid stage is 1.0%.

positive performance in four of five observed periods — negative

returns between Q3 1990 and Q1 1991 (with average annualized • Quality has underperformed in Early stages, with negative

returns of only -0.1%). Average performance for Recession average returns in all five observed complete periods and

stages is 3.9% and statistically significant. the beginning partial period starting in 1976. Average

underperformance for Early stages is -2.1% but not

statistically significant.

Stage Excess Return Tracking Error Information Ratio N P-value

Early -2.1% 4.0% (0.54) 133 7%

Mid 1.0% 3.2% 0.30 243 18%

Late 2.8% 3.7% 0.76 105 2%

Recession 3.9% 4.8% 0.82 75 4%

Full Period 1.0% 3.8% 0.26 556 8%

Definitions for categories above listed on page 6

Introduction Observing the performance of Quality for each of these unique

periods yields evidence that Quality stocks tend to perform better

Quality stocks have been shown in studies to have robust historical in Late and Recession stages, while underperforming in Early

performances. This analysis takes a deeper look into the Quality stages. Quality’s performance in Mid stages is also generally solid;

1

factor’s performance by breaking out its history into the four however, there are multiple periods in this stage where the

stages of the business cycle: Early, Mid, Late, and Recession. Quality factor has underperformed, including the late ’70s and the

mid 2000s.

1 Asness, C.S., Frazzini, A. & Pedersen, L.H. Quality minus junk. Rev Account Stud 24, 34–112 (2019). https://doi.org/10.1007/s11142-018-9470-2

1 Polen Capital

Quality’s Performance Across the Business Cycle